It is Nimiq’s mission to deliver the world’s easiest-to-use, censorship-resistant payment ecosystem. In this blog post, you can discover how Nimiq is working on making it super easy for online merchants to accept crypto and receive conventional money, without using a centralized exchange or payment processor. We also explain the main problems why online merchants don’t like accepting crypto payments, and the solution that Nimiq is building to address these.

Summary for the impatient

- This first non-custodial payment solution offers unprecedented safety against hacks

- Merchants get EUR into their SEPA account fast while practically eliminating the volatility risk

- Users get the convenience of paying with NIM, BTC & ETH as they like

Why don’t online businesses accept crypto?

We set out to understand why only few online merchants accept cryptocurrencies. What we learned made perfect sense to us.

Online merchants have a simple problem if they accept crypto: They still have to pay their employees and suppliers in their national ‘fiat’ currencies (USD/EUR). To do that, crypto payments they accept need to be converted. Only then can they pay their employees and other expenses. This extra step costs time and money, whilst accepting crypto brings only few benefits to the merchants.

We identified the following pain points for online merchants:

- Profit margins can get killed by crypto volatility and fees. Overnight price drops of 5% or 10% can kill any profit margin. The average profit margin of an online merchant is only between 0.5% to 3%. A sudden drop of crypto value can be particularly painful the night before payroll.

- The belief that crypto is unsafe. Merchants dread losing their money. Banks have to guarantee the funds they hold (more or less) and crypto payment services often come with lower levels of guarantee. While it has been ten years since people lost money in the financial crisis, reports about lost crypto funds appear on a somewhat regular basis. Is it any wonder that businesses still feel safer with traditional high street banks?

- Time consuming payouts. On top of the volatility, online merchants have to wait for their fiat funds to be paid out to their bank accounts. The reason are lengthy payment processes.

How Nimiq solves these merchant problems

The Nimiq ‘Open Asset Swap Interaction Scheme’ (OASIS) is key to the solution. As a first strong use case for Nimiq we are focusing our energy on applying this framework to solving the problems of one target group: online merchants.

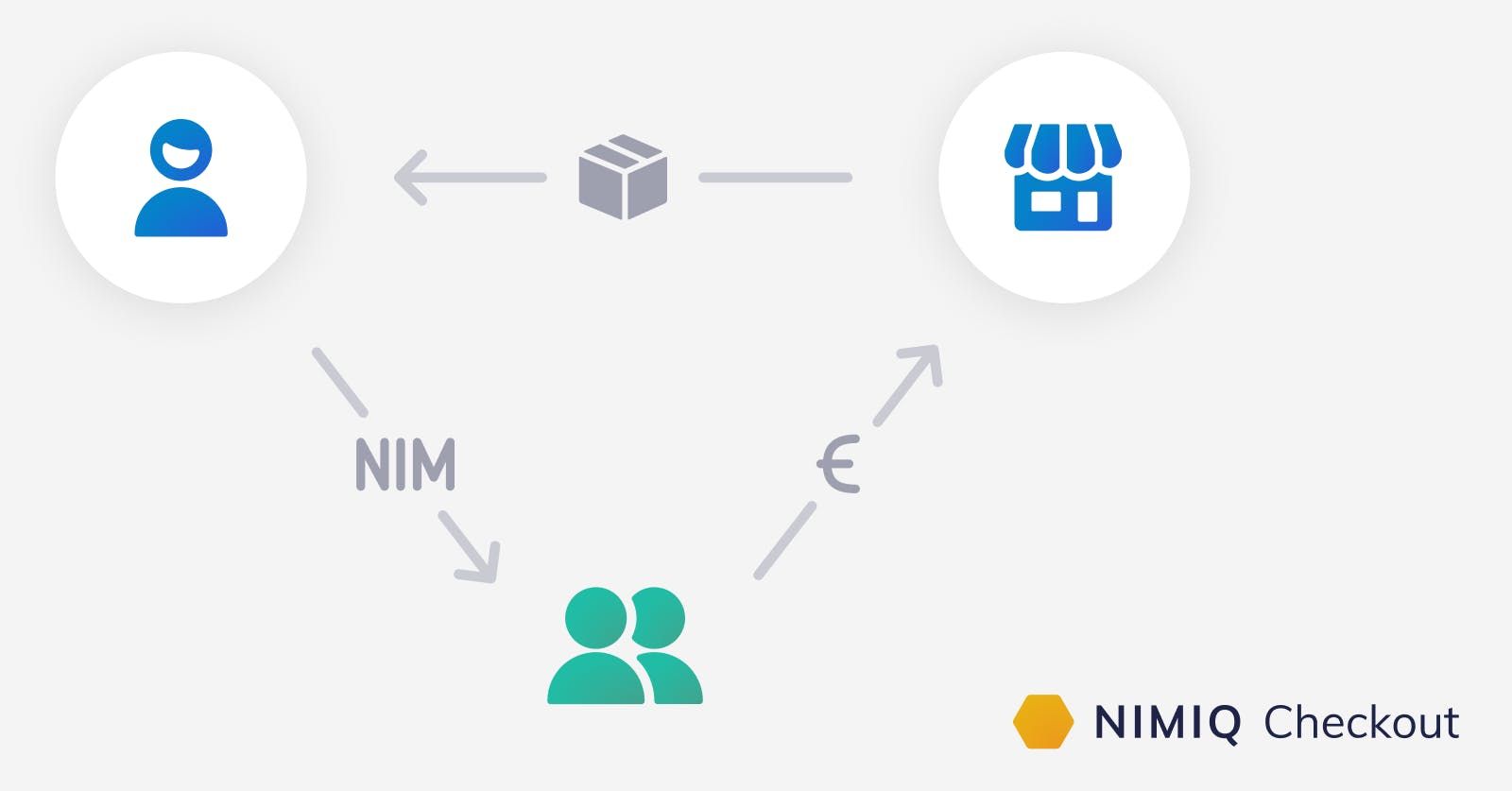

The Nimiq OASIS framework solves online merchants’ main problem by practically eliminating the volatility risk. This happens by OASIS connecting the crypto-paying customer, the liquidity providers (such as market makers or decentralized exchanges), and the online merchants through a mechanism called the Fiat Atomic Swap. Atomic Swaps happen at a predetermined rate. They can thus secure a fixed fiat exchange rate for the merchant.

Secondly, it solves the security concern. It does so by cutting out any custodial third party, e.g. a typical payment processor. This way, no intermediary ever controls the crypto and fiat, that is changing hands, in any centralized or custodial fashion.

And thirdly, the Nimiq OASIS framework enables speedy payouts into the online merchant’s bank account. This is possible because the framework connects both the blockchain world and the banking system (SEPA to begin).

In essence, with “Nimiq Checkout” we are building an e-commerce checkout solution that leverages the OASIS framework such that online merchants can accept crypto and get paid

- in conventional money

- at zero risk for fraud

- with prompt deposits into their bank accounts.

How does OASIS work?

Nimiq OASIS utilizes a mechanism that came to prominence in 2017. It is the basis of decentralized exchanges: the Atomic Swap. Atomic Swaps allow direct exchange with crypto currencies across blockchains, e.g. Bitcoin for Ether without the risk that comes with organizations like centralized exchanges. Eliminating the need for these organizations reduces the risk of hacks and embezzlement. In an Atomic Swap, the buyer and the seller interact through a special kind of smart contracts. This type of smart contract locks the funds of the trading partners for the intended transaction. The transaction will only execute if certain conditions are met. This lock-up allows eliminating risk associated with third-party custodians, like an exchange or payment service provider.

Now, this swap mechanism works well between cryptocurrencies on different blockchains. But what if someone doesn’t want to convert between two cryptocurrencies but between a cryptocurrency and, let’s say, USD/EUR — like our online merchant? Up until now, this was impossible because conventional money can’t be locked on a blockchain.

Nimiq OASIS changes this by extending the concept of Atomic Swaps to conventional currencies!

This is possible by creating a smart contract that interacts with banking APIs. It creates a fiat counterpart to the crypto part of the Atomic Swap. With OASIS, online merchants can now accept crypto and receive national currency. This happens in a decentralized and safe way. It is possible to pair the sale of a cryptocurrency with the purchase of a conventional currency without the risks that come with a third party. It is like putting the Euro on the blockchain (but without a stable coin).

With “Nimiq Checkout”, the online merchants will be able to accept crypto payments and receive fiat payouts (EUR to begin) with little delay and at the lowest risk. At the same time, customers can pay with crypto (NIM, BTC & ETH to begin). Both parties benefit from zero risk exposure because the exchange process can not be manipulated by a third party. This is because it is managed by smart contracts.

Nimiq is currently working with WEG Bank and aims to connect a first online merchant and non-custodial liquidity provider to demonstrate the first Nimiq OASIS transactions by end of the year. Stay tuned for more updates in the future!

Pura Vida,

Team Nimiq