Nimiq 2.0 Supply Curve Voting

Nimiq 2.0 Supply Curve Election and Options

08 Apr 2020

by

11 min

Last month we published the Nimiq 2.0 Supply Curve Considerations, provided tools to analyze it more easily, discussed it with the Nimiq community and hosted an AMA. Now we want to share with you the next steps in this sensitive process.

[UPDATE 2: The follow-up ranking vote concluded on June 8, 2020 and the NIM supply curve for Nimiq 2.0 has been determined as the "BLUE" curve (community suggestion). See results here.]

[UPDATE 1: First vote concluded May 18, 2020 with "YES" on making an adjustment to the NIM supply curve. See results here.]

How did we get here?

A fundamental aspect of a cryptocurrency is the emission rate of the coin. This is the amount of rewards that participants, be it miners or stakers, receive for supporting the network and validating transactions. During the last year, we noticed increasing requests to consider changing this rate. Changing the rate is serious business since it is potentially related to a lot of different factors like the security of the network, perception of the project to newcomers, incentives for new participants and possible price developments from increasing scarcity.

A change in the supply curve clearly impacts the entire Nimiq Ecosystem. This decision has to be taken together. We felt responsible for providing a starting point for this discussion. Thus, we worked with an economic modeling advisor (former Morgan Stanley Smith Barney, now a director at Gemini Finance) who works in asset valuation and advised us in creating the assumptions and restrictions, reducing complexity and identifying reasonable boundaries. The advisor’s suggestions were used as inspiration to write the Nimiq 2.0 Supply Curve Considerations and kickstart these discussions.

The Nimiq Community got actively involved and even created tools to analyze and discuss potential supply curves. We also provided a spreadsheet for users to play around and find out what each curve means for them in the short-, medium- and long-run. Discussions were held in a thread of the Nimiq Forum. Soon, we felt the need to have an active discussion to give feedback, so we held an AMA with the team members most knowledgeable regarding this topic to answer all questions of the community.

Based on those discussions and a casual poll we ran in our Twitter account, it is clear that various opinions exist in the community. The poll shows that 63%, the majority, appear in favor of a change, 17% are against it (leaving 20% undecided). For a solid decision process we realized that a formal voting process, that involves the community whilst protecting the project from stalling to a dead end, is necessary. Inspired by community suggestions, we believe we have designed a voting process that allows users to make their voices heard in a fair and transparent way.

Things to Consider

Before we go on, let’s get some concepts down.

Emission Rate

One of the most fundamental parameters: the emission - also sometimes referred to as “inflation” - is the number of coins that get added to the supply per time unit. Of course, the higher the emission in the beginning, the lower it has to be towards reaching the emission cap.

As prices are built by supply and demand, a higher supply usually means a lower price. So, when looking at the rewards, one should also take the dilution (“inflation”) into account which may affect the price of the coins already in existence.

Stock/Flow ratio

An interesting aspect to consider is the stock-to-flow ratio ("S/F"). It is the ratio between the current supply and the newly added supply per year. Or, in other words, the number of years it would take to reach the current supply from zero, given the current emission rate. Gold has a S/F ratio of 62, Bitcoin currently of 27.5 and after the upcoming halvening it will be 55. As a higher value relates to less supply being added compared to the stock being available, it is a good measure for scarcity. The current supply curve has a ratio of 3.7.

The Next Steps

After considering the results from the Twitter Poll and the suggestions from the community in the discussion threads, we came to the following conclusion regarding the voting process:

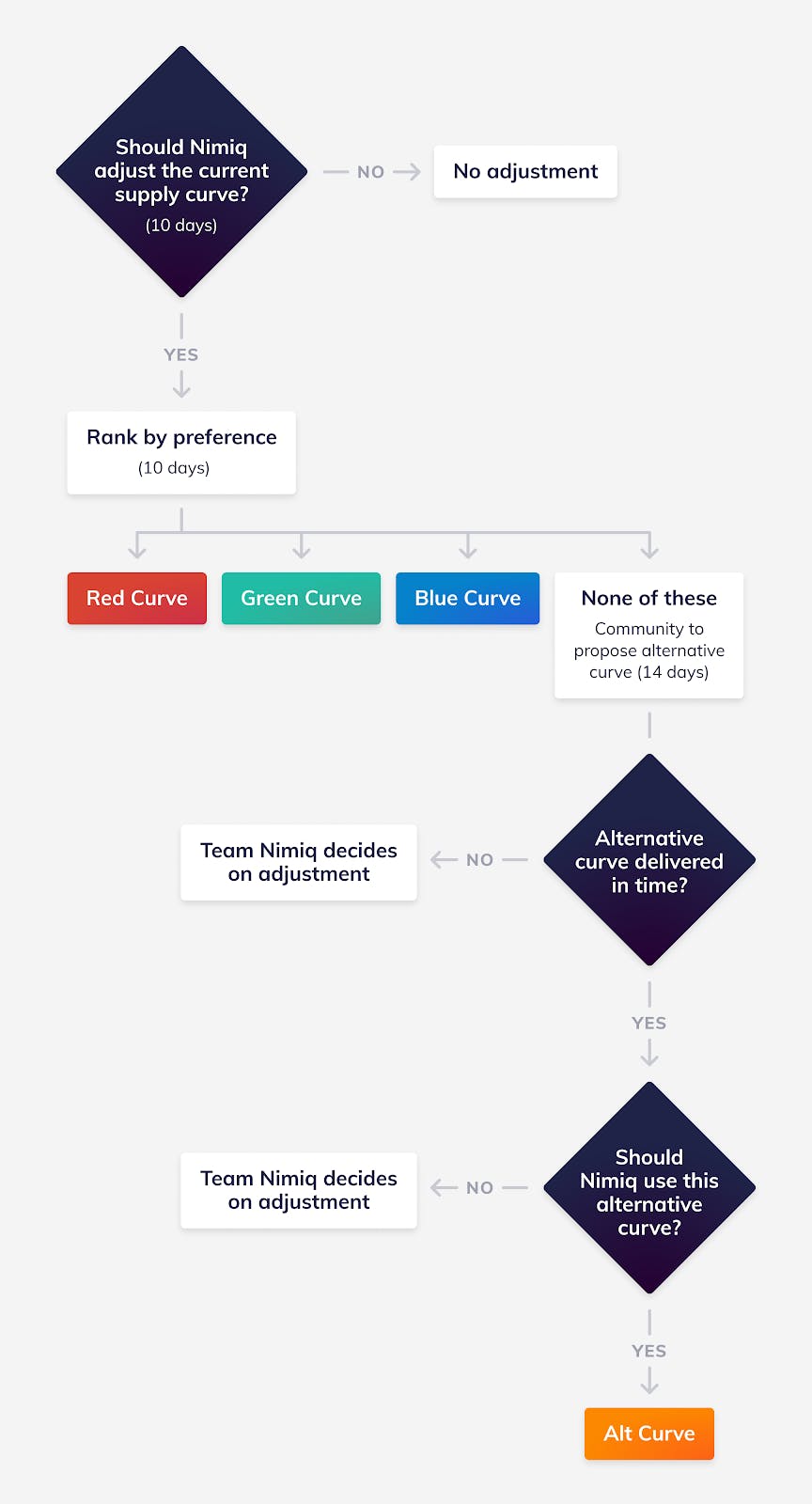

- Voting first whether or not the emission rate should change: It cannot be assumed that the entire community wants the supply curve to change. After all, there are a good number of long time stakeholders that have supported the project with the current supply curve. [UPDATE: First vote concluded May 18, 2020 with "YES" on making an adjustment to the NIM supply curve. See results here.]

- Suggesting an upper and lower bound: To narrow down the endless possibilities of curves, both a soft upper and lower limit were modeled. They now represent the suggested two approaches to lower initial inflation/reward versus higher initial inflation/reward of the curve choices.

- Feedback from the community: A thoughtful suggestion from the community for a curve between the given bounds was added as a third suggestion in the election.

- Give the community the option to create an alternative curve: If you strongly feel that none of the three curves presented in the election process is the curve that you would like to see in Nimiq 2.0, then it makes sense for you to vote “I don’t like any of those”. Note that this will come with the attached obligation as outlined in the following item:

- Prevent the elections from getting stalled: If the majority doesn’t like any of the suggested three curves in the elections, we will give the community a time frame of two weeks to organize and submit an alternative proposal. If this fails, the responsibility to make a final decision falls back on Team Nimiq.

- Voting time frame: Ten days is the time frame for everyone to submit their votes in each of the two voting rounds.

- Ranked votings: Instead of voting for a single hard choice this complex topic benefits from users rating the selections from favorite to least favorite which the voting tool will support for the second round. [UPDATE: Vote concluded on June 8, 2020 and the NIM supply curve for Nimiq 2.0 has been determined as the "BLUE" curve (community suggestion). See results here.]

- Excluding Nimiq Foundation and ImpactX Charity: The Nimiq Foundation and Nimiq’s ImpactX Charity will not participate in voting with their funds. That way any arguments concerning bias through those entities is prevented.

- Recorded on the Nimiq Blockchain: Following the proven use case of voting with the Nimiq Blockchain, we are building an application that enables users to vote by sending a transaction with their vote attached as a message. This way we enable anyone to transparently check the votes and create reports. Before the elections are started, a fixed block height is announced that marks the end of the voting. At that exact block height, a snapshot of the blockchain state is taken so that we have the balance of each address that has sent a vote. This approach is standard and solves the problem of voting multiple times by moving funds to a new address. And it has a nice side effect: if you change your mind, just vote again during the voting period, only the last vote counts.

- One NIM one vote: Every address that votes will be weighted according to the NIM it holds.

- Age doesn’t matter: Bringing age into play is tricky, in life and also when it comes to voting. Funds may have been moved, which is a normal thing to do with funds. We have reviewed various angles and the safest, most straightforward approach is a simple majority voting via balance.

Based on these we came up with this process:

How will voting work?

We will use the new Nimiq Voting App that we are building right now [UPDATE: the app is deployed. see Voting Procedure Blog for current timeline and voting instructions]. The first vote will determine if the curve will change and thus if there is a second round. The second round is about the specific type of curve that the project should then proceed with. Three options are provided which are explained below. Another option provided is “None of the suggested curves.” If this option wins, it then would require the community to organize and step forward to provide an alternative curve option which would then be voted upon. If such an alternative is not presented within 14 days or following an additional voting round is rejected, the responsibility to make the decision will fall back on Team Nimiq, thus prohibiting this process from entering an endless cycle. As stated above, the NIM held by Nimiq Foundation as well as the ImpactX Foundation will notparticipate in any of the voting.

Meet the curves

First of all, describing supply curves is complicated. If you want to dive down into the numbers, please read the specific blogpost, this thread in the forum, check out this video explaining the supply curve considerations and sheet and finally try tweaking the numbers yourself in the spreadsheet.

From discussions within the team and together with the community, three supply curves have manifested as good candidates to replace the current supply curve. Let’s have a closer look.

Disclaimer: We are doing this in an attempt to help users understand more about the curves, this should not be considered financial advice or the team vouching for a specific curve. For purposes of this discussion, the models assume a switch to Proof-of-Stake (and with it any potential new supply curve) on April 14 2020. This is not an actual timeline and all numbers are approximations and subject to implementation adjustments.

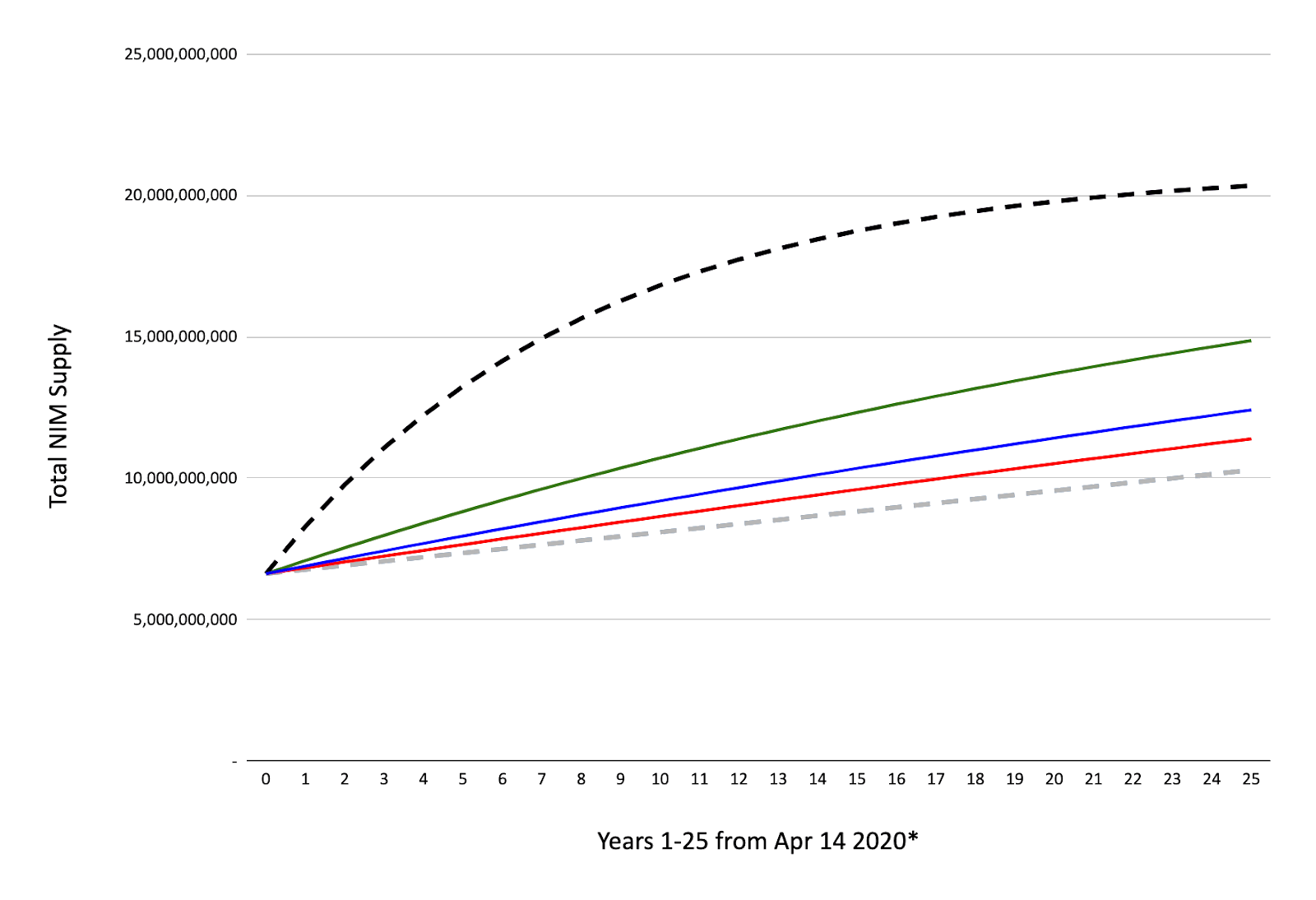

CURRENT Curve (black dashed):

To set the stage for comparison, here the overview for the current supply curve. It has a high emission/reward rate currently around 3’445 NIM per minute which equates to the much debated 28% annual coin supply growth (“inflation”), the main reason for this voting altogether. This emission/reward decreases by -12.04% per year. The current stock-to-flow ratio stands around 3.7 which can be considered very low compared to Gold (62) and BTC (27.5). Here the overview of estimates in time (from switch to PoS) for the coin supply, inflation percentage, staking return percentage and reward per minute:

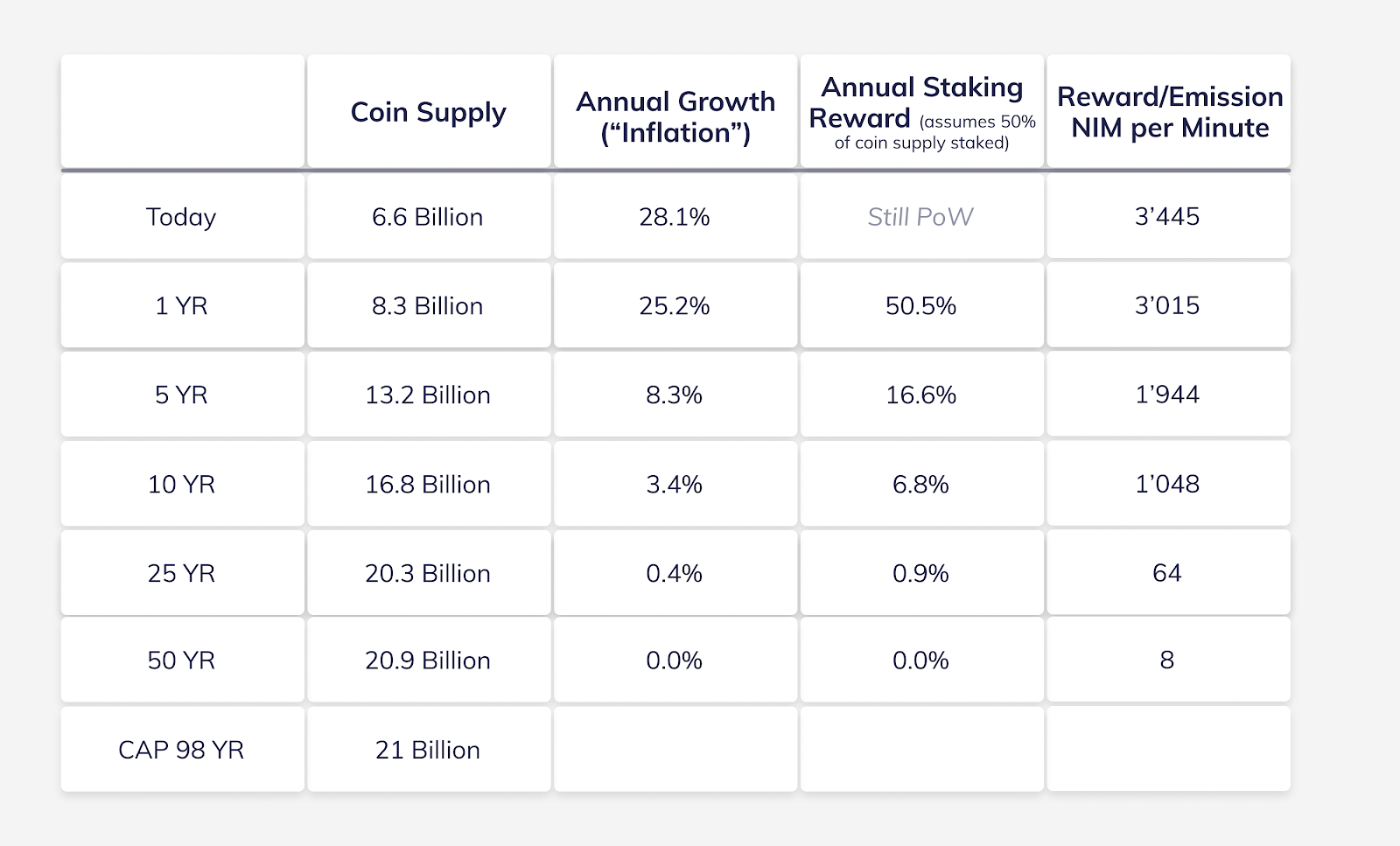

GREEN Curve: The staker’s friend

More coins emitted in the beginning means more rewards but also less initial scarcity as well as lower rewards at later stages. While less than the CURRENT supply curve, this one has the highest initial emission rate of all three suggestions. This curve starts at 900 NIM per minute which equates to a first year coin supply growth (inflation) of just over 7%. This emission/reward decreases by -3.15% per year. The initial stock-to-flow ratio stands around 14. Here the overview of estimates in time (from switch to PoS) for the coin supply, inflation percentage, staking return percentage and reward per minute:

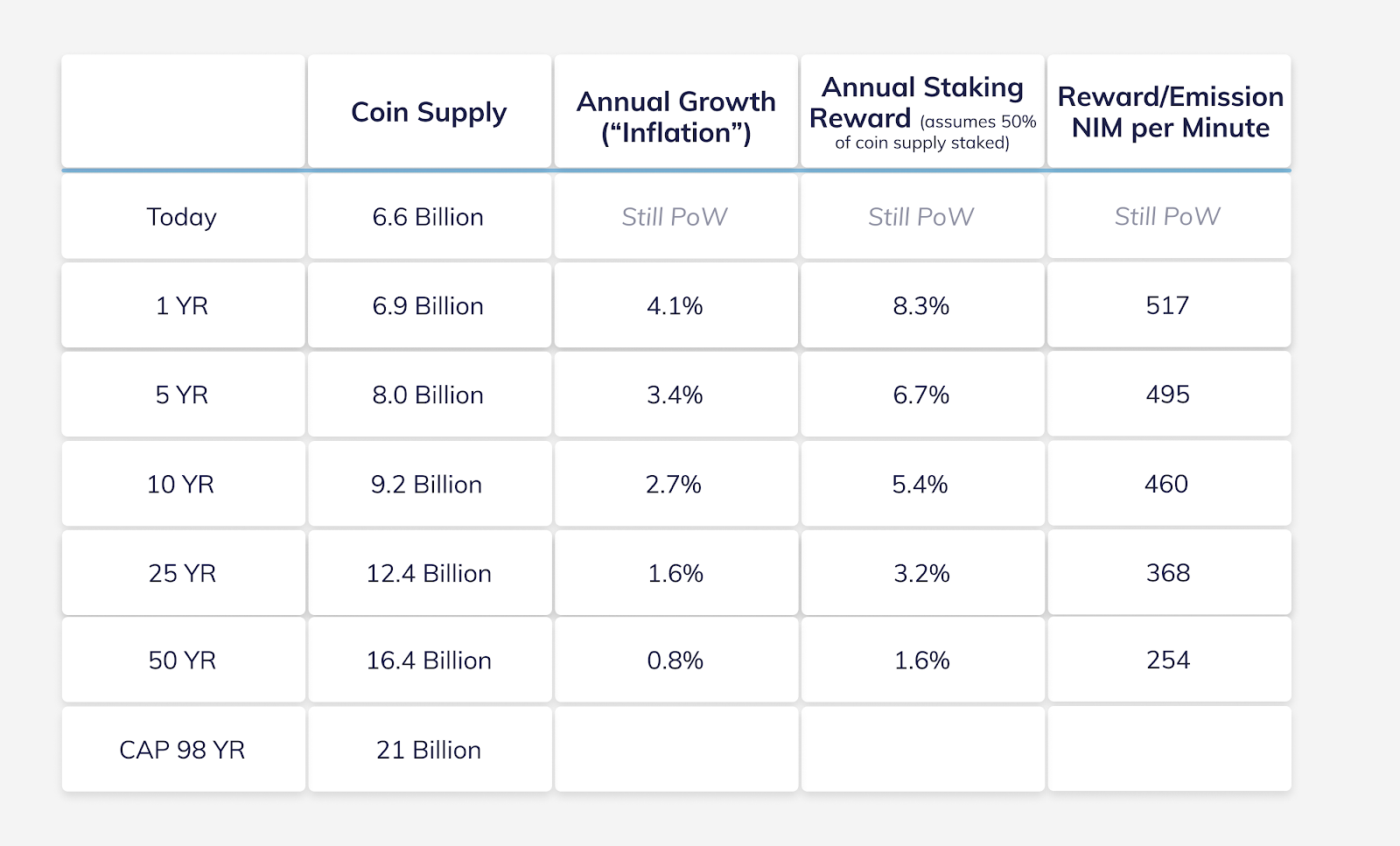

RED Curve: The HODLer’s choice

Less coins emitted in the beginning means more initial scarcity while maintaining a relatively higher reward at later stages. It comes with an initial stock-to-flow ratio of 32 (slightly above BTC). This curve has the lowest initial emission rate of all three suggestions. It starts at 400 NIM per minute which equates to a first year coin supply growth (inflation) of just over 3%. The emission/reward rate of this curve is the most stable of all three suggestions as it decreases by only -0.79% per year. Here the overview of estimates in time (from switch to PoS) for the coin supply, inflation percentage, staking return percentage and reward per minute:

BLUE Curve: The balanced one

[UPDATE: Blue is winner of NIM supply curve for Nimiq 2.0!]

This community suggestion is a balance between high and low, GREEN and RED, with the idea to optimize between initial scarcity and reward amounts over time. It’s initial stock-to-flow ratio is 24. It has an initial emission rate of 525 NIM per minute which equates to a first year coin supply growth (inflation) of just over 4%. The emission/reward rate of this curve is reasonably as it decreases by -1.47% per year. Here the overview of estimates in time (from switch to PoS) for the coin supply, inflation percentage, staking return percentage and reward per minute:

What to keep in mind

- The curve should reach the 21 billion NIM after 100 years from Mainnet start as stated in the original terms of the token generation.

- The new supply curve should be closer to existing, generally accepted economic ideals, reducing the emission, which has also been requested by multiple community members.

- We want a competitive staking model that is attractive to the community while reinforcing the security of the decentralized blockchain both in the short as well as longer term.

For additional pointers review Nimiq 2.0 Supply Curve Considerations.

When voting?

[UPDATE 2: The follow-up ranking vote concluded on June 8, 2020 and the NIM supply curve for Nimiq 2.0 has been determined as the "BLUE" curve (community suggestion). See results here.]

[UPDATE 1: First vote concluded May 18, 2020 with "YES" on making an adjustment to the NIM supply curve. See results here.]

We are finishing fine tuning the voting app right now . Next, we would like to try it out with a test voting round with active community members just to make sure everything is working as expected. We hope to be ready for that by the end of the week. Start making up your mind, get your NIM ready to vote and stay tuned to Nimiq’s Twitter Account where we will announce the voting once everything is ready.

We would like to thank all the active community members who participated in the discussions, especially Rob and Big Mac who got particularly involved. We truly appreciate you all! :*

Pura Vida,

Team Nimiq

Disclaimer

None of the statements must be viewed as an endorsement or recommendation for Nimiq, any cryptocurrency, or investment product. Neither the information, nor any opinion contained herein constitutes a solicitation or offer by the creators or participants to buy or sell any securities or other financial instruments or provide any investment advice or service. All statements contained in statements made in Nimiq’s web pages, blogs, social media, press releases, or in any place accessible by the public, and oral statements that may be made by Nimiq or project associates that are not statements of historical fact, constitute “forward-looking statements”. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause the actual future results, performance, or achievements to be materially different from any future results, performance, or achievements expected, expressed, or implied by such forward-looking statements. The final decision of implementing any changes to the Nimiq protocol, including its parameters, always remains with the decentralized node operators who agree what version and parameters to deploy and support.